Financing

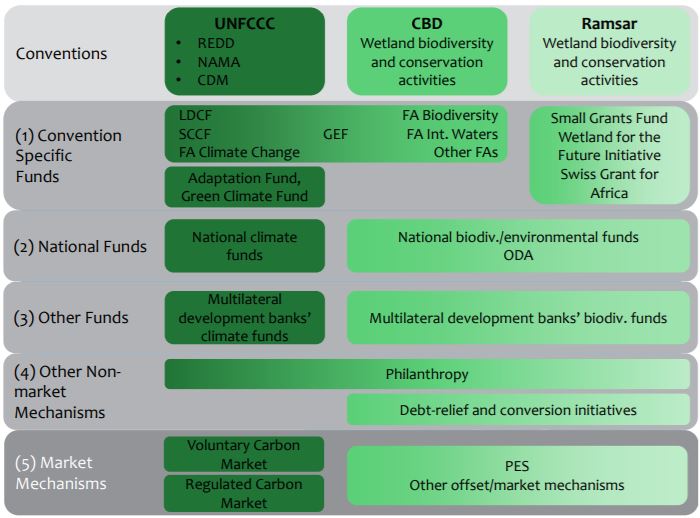

Blue carbon projects and programs can be financed through a variety of mechanisms (e.g., see ref ). They can be supported by funds linked to both climate change and biodiversity-related finance mechanisms, such as through the United Nations Framework Convention on Climate Change (UNFCCC), Convention for Biological Diversity (CBD), or Ramsar.

Government Funding & Development Banks

Under the UNFCCC, blue carbon mitigation and adaptation activities can be financed through these climate-related funds: the Global Environment Facility Trust Fund and its Focal Areas, the Special Climate Change Fund, and the Least Developed Countries Fund. The Green Climate Fund and the Adaptation Fund are other options to finance blue carbon projects. Additionally, blue carbon projects may be financed through climate change funds from development banks (e.g., African and Asian Development Banks, the Inter-American Development Bank, and the BioCarbon Fund as part of the Carbon Finance Unit of the World Bank).

In addition to climate funding, biodiversity-related finance mechanisms can also be used to support the protection and restoration of blue carbon ecosystems (e.g, the Global Environment Facility which supports the Convention for Biological Diversity and several funds that support Ramsar: Wetlands for the Future Small Grants Fund, Swiss Grants Fund, and the Nagao Wetland Fund. ref

The combination of biodiversity and carbon funds can leverage additional resources for activities with a win/win situation for biodiversity as well as climate change mitigation and adaptation.

Overview of main climate (dark green) and biodiversity-related (light green) finance mechanisms that are relevant for blue carbon projects. Source: Herr et al. 2014

Regulated and Voluntary Carbon Markets

Carbon markets provide an important funding stream to support the conservation and restoration of blue carbon ecosystems. Carbon markets are based on the idea that stored carbon can be quantified and sold as credits that the buyer uses to offset emissions (i.e., emissions trading). Carbon credits are verified and then sold on the compliance market or voluntary market.

Voluntary carbon markets enable businesses, governments, NGOs, and individuals to offset their emissions by purchasing voluntary emissions reductions and in some cases, also deliver social, economic and biodiversity co-benefits. In other words, businesses may receive certified carbon credits to manage their emissions in exchange for investing in protecting/restoring blue carbon ecosystems.

Relevant mechanisms include Reducing Emissions through Decreased Deforestation (REDD+) and National Appropriate Mitigation Actions (NAMAs) for developing countries to access international carbon mitigation financing streams and to implement national programs and policies. Clean Development Mechanisms (CDMs) and voluntary carbon markets can be used at local scales to support climate mitigation actions including the conservation of blue carbon ecosystems.

Debt restructuring in the Seychelles will provide funding to support adaptation to climate change through improved management of coasts, coral reefs and mangroves. Photo credit: Jason Houston

However, carbon finance alone may be insufficient to support the protection of blue carbon ecosystems, thus it is important to explore a range of financing options that complement carbon activities with non-carbon-based financing sources (e.g., Payment for Ecosystem Services and debt-for-nature swaps ref).

Other Funding Options

- Grants and private philanthropy - one of the most flexible ways to fund blue carbon work

- Innovative financial mechanisms can provide access to new forms of finance or additional revenue streams for conservation. Examples include:

- Payments for ecosystem services - use a direct market to receive payments for specific activities

- Promotion of “green” products and markets

- Blue bonds

- Use of risk transfer and insurance mechanisms and mitigation actions such as biodiversity offsets utilized by businesses practicing corporate social responsibility

- Debt-for-nature swaps ref and carbon sequestration could now be considered as an additional objective for project activities funded under these types of initiatives. ref

Resources

Financing Options for Blue Carbon: Opportunities and Lessons from the REDD+ Experience

Keep it Fresh or Salty: An Introductory Guide to Financing Wetland Carbon Programs and Projects

Protecting Seagrass through Payment for Ecosystem Services: A Community Guide – this downloadable guide is available in English, French, and Spanish