Cross-Cutting Finance Mechanisms

The following conservation finance mechanisms apply multiple elements from the four primary instrument categories introduced on the previous page of this toolkit. They also act as fund vehicles that receive, aggregate, and distribute funds to MPAs and other conservation projects. These cross-cutting mechanisms should be understood as powerful supporting mechanisms that allow MPAs to combine multiple finance streams while also centralizing the independence, monitoring, and transparency that are required for long-term, sustainable MPA financing.

Conservation Trust Funds (CTFs)

Conservation trust funds (CTFs) are defined as “private, legally independent grant-making institutions that provide sustainable financing for biodiversity conservation." ref CTFs raise and invest funds from diverse sources (e.g., philanthropy, governments, private sector contributions, and fees and payments) and direct those funds to conservation programs in the form of grants. Perhaps even more important than the financial revenues that CTFs can generate are all the indirect benefits related to having a good governance structure in place for conservation. The Conservation Finance Alliance's Practice Standards for Conservation Trust Funds is an excellent publication through which to learn more about the value of CTFs.

CTFs provide various ways to address governance challenges associated with MPA financing, such as:

- Establish thoughtful strategies to attract and manage funding from diverse sources

- Bring together stakeholders with varying capacities and interests

- Force the adoption of robust governance, clear processes, and transparent financial structures

- Promote strategic focus, rigorous monitoring/assessment, and high levels of transparency and accountability

CTFs can be a way to do strategic planning, to convene all the right stakeholders to ensure that there are robust governance procedures in place, co-lead management with Indigenous Peoples and local communities, and to do rigorous monitoring and evaluation. Taking all these elements together, CTFs can be an essential source of good governance for the management of marine protected areas and protected area systems. ref

Enabling Conditions

- Must having a deep understanding of how much establishment of a CTF will cost, as well as likely sources of early-stage funding before setting up a fund

- Requires planning for instruments that will provide funding farther along in the future, and funding to address emerging threats that are not yet present in the MPA

- Metrics must be defined and monitoring processes enabled to track ecological objectives

- Should ensure leadership continuity to avoid transition crises

In the following video, Sean Nazerali, Director for Innovative Financing at BIOFUND, the Mozambican foundation for the conservation of biodiversity, talks about BIOFUND as a model for CTFs in the Africa region, including discussion of several innovative financing mechanisms in the categories described on the previous page of this toolkit, including biodiversity offsets, payments for ecosystem services, and philanthropic grants.

CTF Example: The Caribbean Biodiversity Fund

The Caribbean Biodiversity Fund (CBF), established in 2012, supplies long-term funding for conservation in the Caribbean region. The CBF distributes grants to local, regional, and national projects through competitive calls for proposals. Funded actions include ecosystem restoration and rehabilitation, mitigation, artificial reef installation, and grey-green infrastructure solutions. The CBF was established with US$42 million in funding from The Nature Conservancy (TNC), Global Environment Fund, and the Government of Germany, and participation from 8 Caribbean nations. As of 2023, there have been US$67.5 million of funding commitments made, with work taking place in 14 countries.

Nature Bonds Program

The Nature Bonds Program is a debt-for-nature swap program of TNC that uses sovereign debt refinancing coupled with robust conservation to help countries deliver on their conservation and climate commitments and support local communities. Through Nature Bonds Projects, TNC supports countries to refinance debt so that the country can use those savings to fund conservation. The Nature Bonds Program agreement does not add additional burden to existing debt levels.

Nature Bonds Projects are established through legally-binding conservation commitments and the creation of a new, independent CTF (or the selection of an already-existing independent CTF) that will manage the income and disbursements. The CTF receives funding through the Nature Bonds Project, and routes funding streams to identified conservation priorities. TNC and other partners also commit to provide technical assistance, including marine spatial planning support, engagement with local NGOs and communities, and capacity building for in-country staff to implement the promised conservation actions.

Enabling Conditions

- Nature Bonds Projects restructure existing debt, so are only available to low-income nations or countries with poorer credit ratings

- Funding streams generated by Nature Bonds Projects must be managed and distributed by an independent CTF, to ensure transparent governance and financial accountability

- There must be appropriate data, knowledge, capacity, and participation to ensure that credible conservation plans can be generated as part of the Nature Bonds Project

To learn more about TNC's Nature Bonds Program, visit the Nature Bonds Toolkit.

Nature Bonds Program Example: Belize Blue Bonds for Ocean Conservation

In late 2021, The Nature Conservancy and the Government of Belize closed on the Belize Blue Bonds for Ocean Conservation. In exchange for committing to provide approximately US$180 million to conservation over a 20-year duration and to protect 30 percent of Belize's oceans, the Blue Bonds Project provided immediate economic relief to Belize in the form of a debt-to-GDP reduction of 12 percent. The Belize Blue Bonds Project included eight milestones that the government must reach in order to demonstrate their commitment, including expanding the area of Belize’s ocean in Biodiversity Protection Zones, designating public lands as mangrove reserves, and initiating and completing a marine spatial planning (MSP) process. The MSP in Belize is known as the Belize Sustainable Ocean Plan (BSOP).

As a part of the Belize Blue Bond Project, an independent CTF, the Belize Fund for a Sustainable Future (BFSF), was established to deliver funding and provide oversight for conservation activities. The BFSF takes an inclusive and participatory approach while overseeing calls for proposals, technical reviews, and grant award processes, and is responsible for creating and maintaining a monitoring and evaluation framework for all funded projects.ref

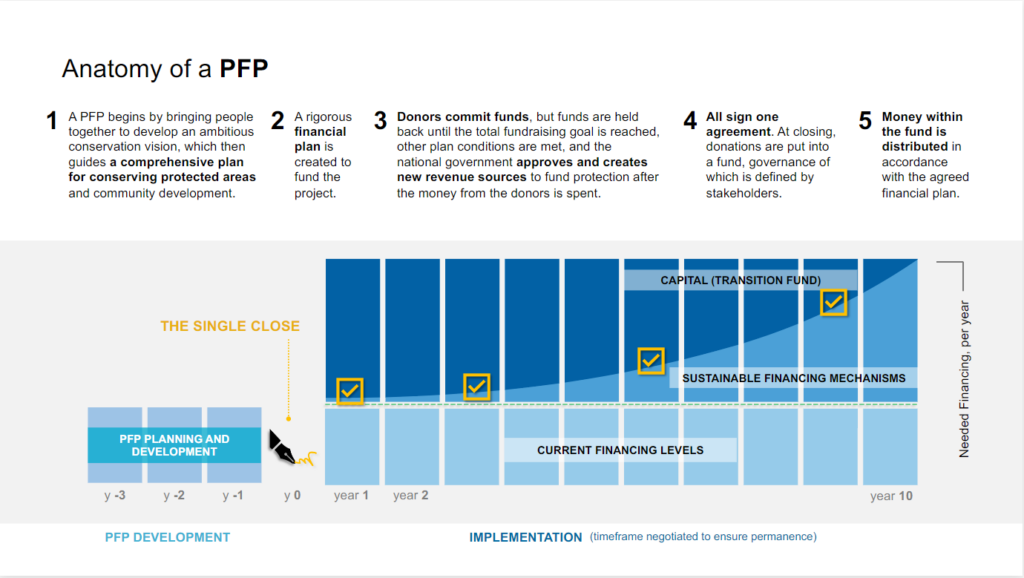

Project Finance for Permanence (PFPs)

PFPs take an approach in which all sources of financing are contingent on all other critical elements of the project being in place, with the funding only released when the deal closes. PFPs bring together philanthropic donors, investors, government leaders, and others, and ensure that all signatories to the multiyear agreement are accountable for conservation outcomes.

The typical structure of a PFP has philanthropic donors contributing funding that is dispersed to the government as the government meets the conservation and policy milestones in the agreement, contributing more money at the beginning of the project and phasing out as the project matures. At the same time, other funding instruments are developed to take the place of philanthropy as the philanthropic contributions phase out. TNC's Nature Bonds are often planned as a part of a PFP deal (a Nature Bond does not need to be in place at the time of closing the PFP, but does need to already be agreed upon) as a sustainable financing mechanism.

Chart showing the stages of development of a PFP. Source: The Nature Conservancy

Enabling Conditions

- Conservation must be planned to take place across entire social-ecological systems, requiring management at local, regional, and national levels

- Planning must include both scientific AND financial modeling

- The agreement must include strict closing and disbursement conditions, including an independent board and a fund management policy

- All stakeholders to the deal must be willing to come together for a single closing once all financial resources are fully committed

- The government must be able to agree to the timeline and milestones laid out in the plan

PFP Example: Great Bear Sea Marine Protected Area

The Great Bear Sea Marine Protected Area will build on the Great Bear Rainforest PFP, a terrestrial PFP adjacent to the Great Bear Sea that was established in 2007. The Great Bear Sea is particularly notable for being an Indigenous-led PFP project, bringing together Indigenous organizations, governments, and philanthropy to co-create shared goals for grounding conservation goals in science, Indigenous knowledge, and local perspectives.

The MPA Finance Toolkit was developed in partnership with the Blue Nature Alliance, a global partnership to catalyze effective large-scale ocean conservation. In September 2023, the Western Indian Ocean Marine Science Association and Blue Nature Alliance co-hosted an MPA finance workshop with marine managers in the Western Indian Ocean region. The resources presented in this toolkit were developed for and piloted by the managers in attendance.